Indicators on Amur Capital Management Corporation You Need To Know

Indicators on Amur Capital Management Corporation You Need To Know

Blog Article

Everything about Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation Fundamentals ExplainedAll About Amur Capital Management CorporationIndicators on Amur Capital Management Corporation You Need To KnowUnknown Facts About Amur Capital Management CorporationThe Ultimate Guide To Amur Capital Management CorporationAmur Capital Management Corporation - Questions

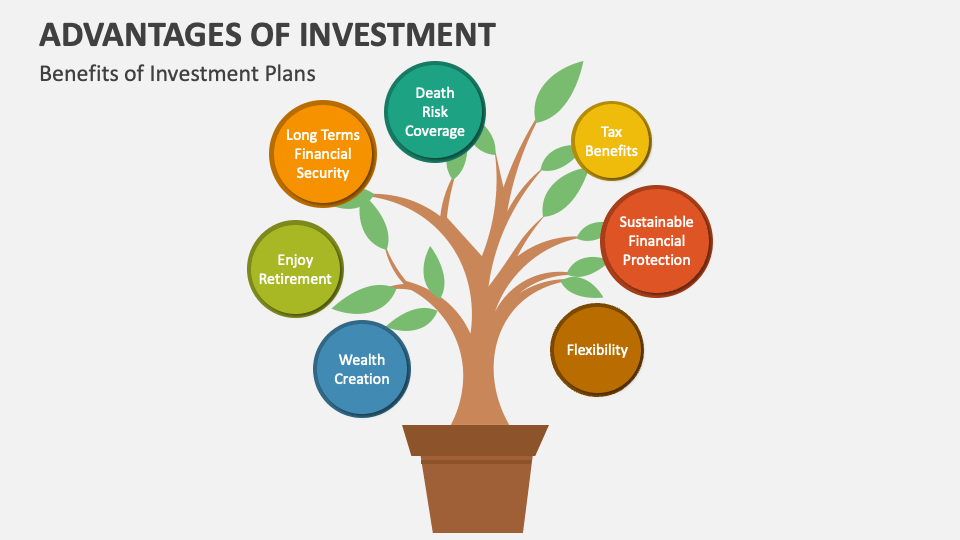

This makes real estate a rewarding lasting financial investment. Actual estate investing is not the only method to invest.

About Amur Capital Management Corporation

Considering that 1945, the average large stock has returned close to 10 percent a year. That said, stocks could simply as quickly decrease.

Nevertheless, it is just that: playing a game. The securities market is as much out of your control as anything can be. If you buy stocks, you will go to the mercy of a fairly unstable market. That claimed, realty is the polar opposite pertaining to particular aspects. Internet incomes in property are reflective of your very own actions.

Any cash got or lost is a straight outcome of what you do. Stocks and bonds, while frequently abided with each other, are fundamentally different from one an additional. Unlike stocks, bonds are not agent of a risk in a company. Because of this, the return on a bond is repaired and does not have the opportunity to value.

About Amur Capital Management Corporation

The actual benefit genuine estate holds over bonds is the time framework for holding the financial investments and the price of return throughout that time. Bonds pay a fixed interest rate over the life of the financial investment, therefore purchasing power keeping that interest drops with rising cost of living in time (investing for beginners in canada). Rental residential property, on the other hand, can generate greater leas in periods of greater rising cost of living

It is as straightforward as that. There will constantly be a need for the precious metal, as "Fifty percent of the globe's populace relies on gold," according to Chris Hyzy, primary financial investment policeman at U.S. Trust, the private wealth administration arm of Financial institution of America in New York. According to the Globe Gold Council, demand softened last year.

Some Known Factual Statements About Amur Capital Management Corporation

Therefore, gold rates need to return down-to-earth. This must draw in innovators wanting to profit from the ground level. Identified as a news fairly risk-free commodity, gold has actually established itself as a lorry to raise financial investment returns. Some do not even think about gold to be a financial investment at all, instead a bush versus inflation.

Certainly, as safe as gold might be considered, it still stops working to continue to be as eye-catching as property. Below are a couple of reasons financiers like genuine estate over gold: Unlike realty, there is no funding and, for that reason, no room to utilize for growth. Unlike realty, gold proposes no tax advantages.

5 Easy Facts About Amur Capital Management Corporation Shown

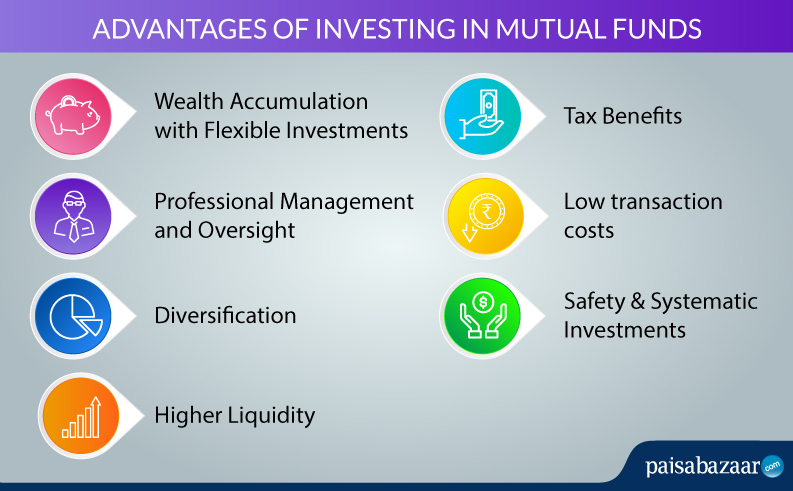

When the CD develops, you can collect the initial investment, in addition to some interest. Deposit slips do not appreciate, and they've had a historic typical return of 2.84 percent in the last eleven years. Real estate, on the other hand, can value. As their names suggest, shared funds consist of funds that have actually been merged with each other (best investments in canada).

It is just one of the easiest means to branch out any kind of portfolio. A common fund's performance is constantly determined in terms of complete return, or the sum of the modification in a fund's web property value (NAV), its returns, and its resources gains distributions over a given duration of time. However, a lot like stocks, you have little control over the efficiency of your possessions. https://anotepad.com/note/read/2j524k8q.

Positioning cash into a common fund is basically handing one's financial investment choices over to a professional cash supervisor. While you can select and pick your investments, you have little say over exactly how they carry out. The 3 most usual methods to buy realty are as complies with: Get And Hold Rehab Wholesale With the worst component of the economic crisis behind us, markets have undergone historical recognition rates in the last 3 years.

8 Simple Techniques For Amur Capital Management Corporation

Buying reduced does not suggest what it made use of to, and financiers have recognized that the landscape is changing. The spreads that wholesalers and rehabbers have actually come to be accustomed to are starting to invoke up memories of 2006 when worths were traditionally high (accredited investor). Obviously, there are still plenty of possibilities to be had in the globe of flipping realty, however a brand-new departure method has become king: rental residential properties

Or else called buy and hold residential or commercial properties, these homes feed off today's gratitude prices and maximize the truth that homes are extra expensive than they were simply a couple of brief years ago. The concept of a buy and hold leave strategy is easy: Capitalists will seek to enhance their bottom line by renting the property out and accumulating monthly cash money circulation or simply holding the residential or commercial property until it can be marketed at a later date for a profit, of program.

Report this page